Embedded Lending Technology

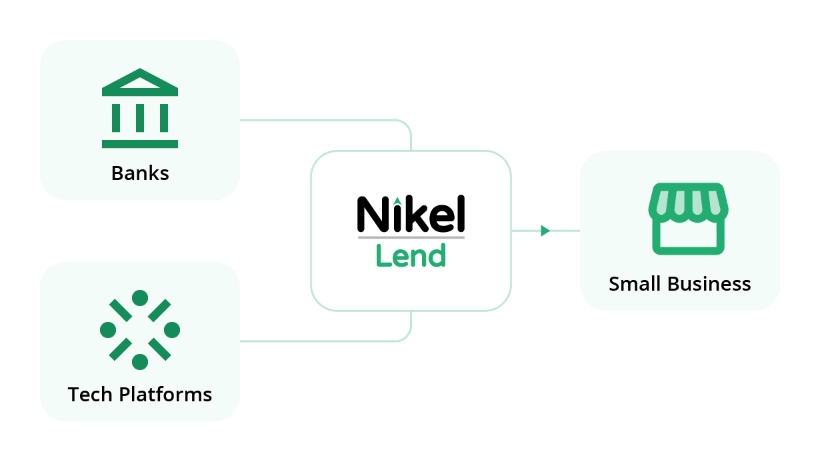

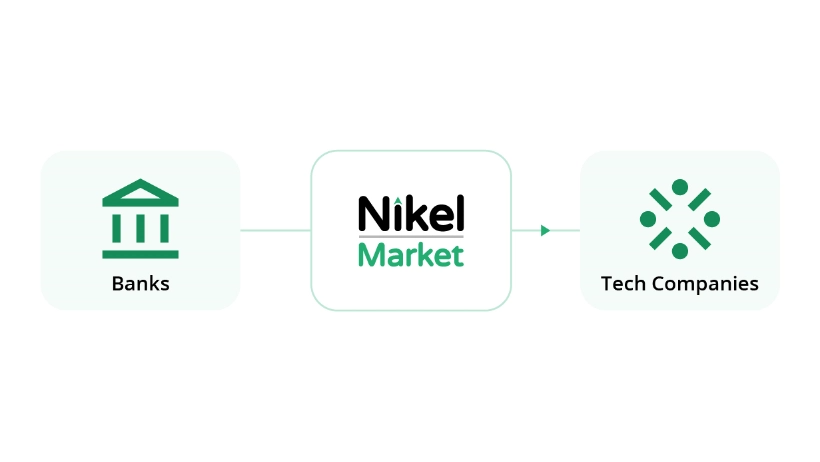

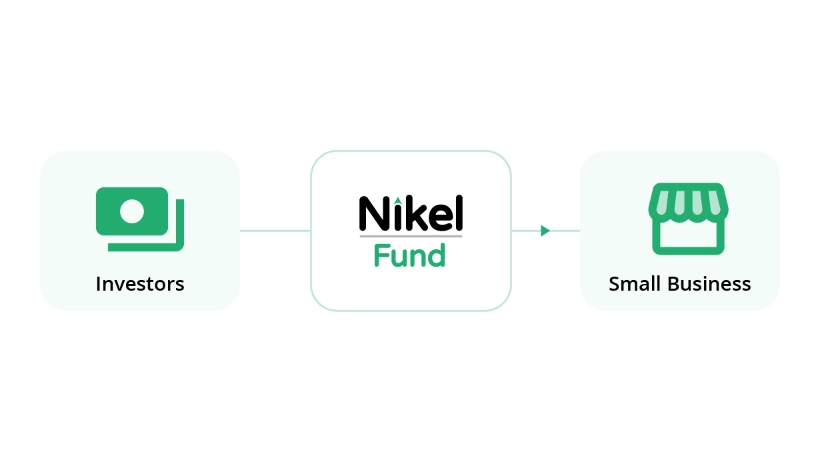

Nikel provides end-to-end lending solutions for banks and technology companies to lend to small businesses.

Our Products

Unlock the Entrepreneurial Potential of Small Businesses

Rosa manages the inventory of her clinic in East Java, and receives credit lines to ensure she’s adequately equipped to serve her community.

Suhadin runs a small trucking company. He transports a lot of goods for large companies but they usually take two months or more to pay his invoices. With Nikel financing, Suhadin can get paid upfront for deliveries to avoid working capital shortages.

Mirna owns a wholesale store in North Sumatra selling essential goods. She’s using Nikel financing to help her purchase inventory to ensure she has enough stock without needing the cash upfront.

Shape the Future of Small Business Lending

At Nikel, we trouble shoot clients’ key challenges in lending through code.